COVID-19 QUICK REFERENCE GUIDE

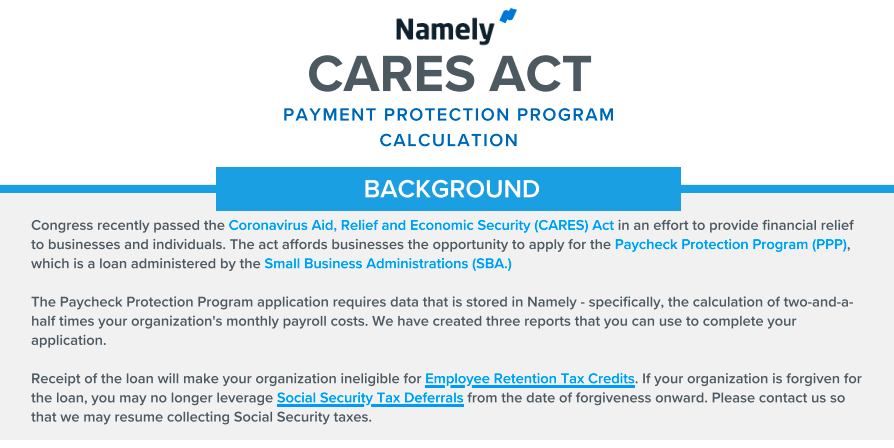

HOW CAN I DEFER PAYMENT ON CERTAIN FEDERAL AND STATE TAXES?

In order to defer payments on federal employer Social Security taxes and eligible state taxes, an authorized administrator will need to complete our Tax Deferral Request Form and Legal Waiver.

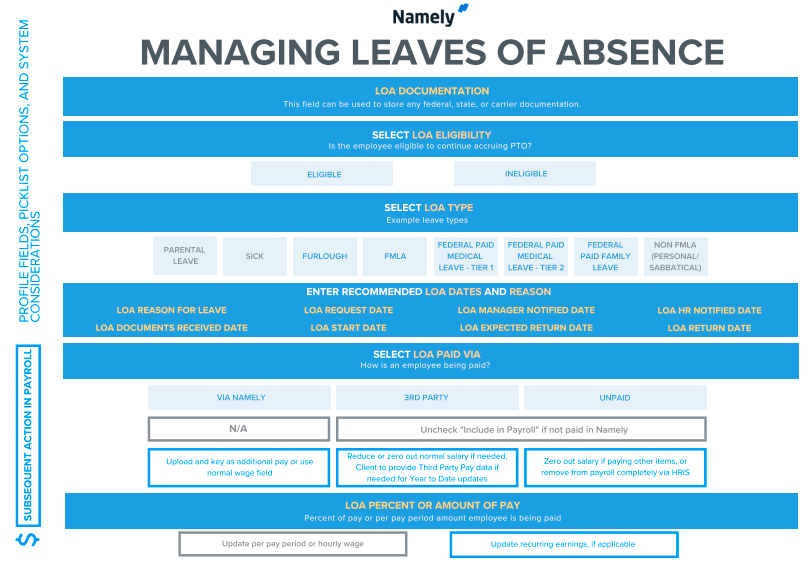

WHAT IS A FURLOUGH, AND HOW CAN I TRACK THIS IN NAMELY?

A furlough is a kind of leave of absence which continues employment, but reduces scheduled hours or requires a period of unpaid leave. Generally, this is not considered termination; however, employees will likely still be eligible for both unemployment and- depending on carrier rules- continued benefits coverage for a period of time.

Using custom fields in HRIS will help you track details of employee furloughs. For instructions on setting up these custom fields, please see COVID-19: Furlough Process.

HOW DO I PAY MY EMPLOYEES FOR THE NEW MANDATED SICK LEAVE OR FAMILY MEDICAL LEAVE?

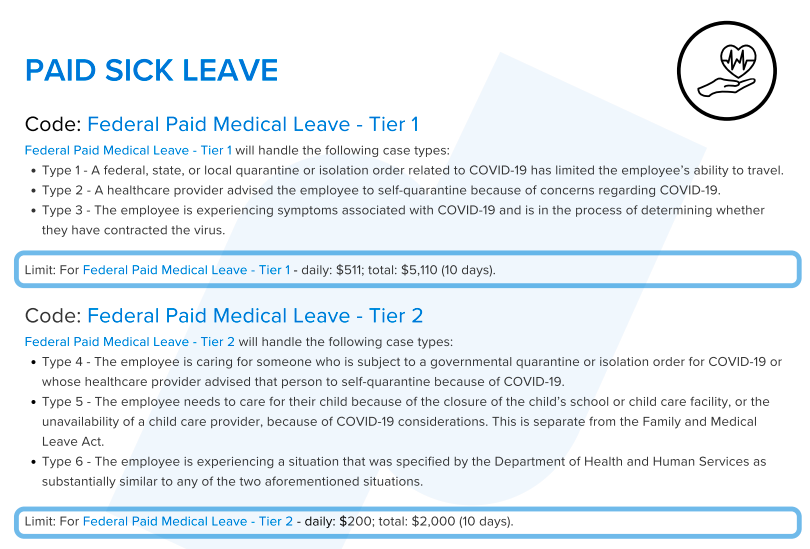

Namely has engineered new codes for these leave types which will respect the annual limits mandated by the federal government and will not collect the employerpaid portion of Social Security taxes. These codes are available now for you to use:

-

Federal Paid Medical Leave - Tier 1: used for Paid Sick Leave, types 1-3

-

Federal Paid Medical Leave - Tier 2: used for Paid Sick Leave, types 4-6

-

Federal Paid Family Leave: used for for Paid Family Leave